Services Offered

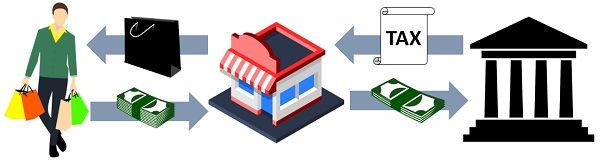

Direct & Indirect Taxation Advisory Services

Domestic Tax Compliances

- Compliance handholding including preparation and filing of Income Tax, TDS returns.

- Tax Planning for all entities and advising on Advance Tax payments

Representations and Litigation and Planning

- Representation for Assessments, Appeals, Refunds and other matters.

- Handling Litigations and Appearing before Appellate Authorities

- Opinions for complex representations, litigation & planning matters.

Indirect Taxation Advisory

Compliance Services and Audits

- Compliances handholding including GST Registration, Payment of duties & taxes, Preparation and filing of returns etc.

- Conducting audits as per the requirement of the statute or compliance audits / Due Diligence Check as per the needs of the clients.

Representations, Litigation and Opinions

- Representation for Assessments, Appeals, Refunds and other matters.

- Handling Litigations and Appearing before Appellate Authorities.

- Opinions for complex representation, litigation and planning matter.

- Advice on proper Classification, Valuation, Applicability of Taxes on Transactions in reference to Benefits / Exemptions.

SwatiPanchalCA

0